Adriacom I Business Services & Immigration

Montenegro Awaits - Let's Make it Yours.

在黑山投资

Investing in Montenegro

Its Economic Model

Investing in Montenegro is investing in one of Europe’s fastest-growing emerging economies. Montenegro offers a dynamic and business-oriented economic framework with clear strategic objectives. Understandably, they want to develop a sustainable economic model based on three pillars:

- Authentic and high-end development of its tourism sector

- Net export of (renewable) electric energy

- Agribusiness in the rural part.

Since its independence in 2006, Montenegro has made major progress towards social and economic development. In its dual goal of EU integration and swift economic development, it has proven to be a safe and incredibly politically stable spot in this part of the world.

Table of Contents

ToggleWhat are Montenegro’s achievements so far, you might ask?

- Advanced Candidate status for EU membership

- NATO member since 2017

- WTO member since 2012

- 90% of state-owned companies privatized

- World Bank and IMF member

- 4.7% GDP growth in 2019

- GDP per capita PPP $17,278

- Human Development Index 49th

source: tradingeconomics.com

Montenegro’s Investment Landscape

Economic Growth Sectors

Montenegro’s GDP has been dramatically going up, from 10,000$ per capita in 2004 to over 17,000$ in 2019. Major infrastructure projects like the Bar-Boljare motorway that will connect it to the European motorway network via Serbia, and large energy and tourism investments showed to edge up economic growth indicators. Especially programs with the goal of eliminating barriers to new investment projects and creating a more positive business environment became imperative. In this context, the adoption of new laws, harmonized with the EU standards, and the implementation of long-needed institutional reforms in the fiscal and financial sectors helped towards a notable improvement of the business environment in the Republic of Montenegro.

Tourism is growing

Favorable tax rates and investment incentives supported by a pro-business political climate have allowed Montenegro to become one of the world’s fastest-growing tourist destinations. In 2019 it hosted more than 2 million foreign tourists, which are up more than 10% from the prior year.

Trade and Transport

The Trade sector is growing complementary to tourism with 6.3% in the first eight months of 2019. The growth was also recorded in the transport sector, where 9.5% more airport passengers were registered at the airports compared to 2Q 2019 / 2Q 2018.

Agribusiness

37% of Montenegro’s total territory is agricultural land. Agriculture in Montenegro is very diverse, from the cultivation of olives and citruses in the coastal belt, vegetables, and viticulture in the central part, to extensive livestock breeding, especially in the northern part of Montenegro. Federal and local governments together with the EU will give ample support to this sector, and there will be export opportunities for food production.

Construction and Real Estate

Positive GDP growth was also registered in the construction sector, wherein 2019 the value of finalized construction works increased by 12.3% in comparison to 2018. The economic activity has picked up since the second quarter of 2016, driven primarily by large-scale infrastructure projects.

There are excellent investment opportunities in Montenegro’s property sector. Since the country features one of the most dramatic coastlines of the world, it will always attract affluent buyers from abroad. Here are the key points:

- Most prime property and major developments are along Montenegro’s Adriatic coast.

- Podgorica the capital city is dominated by domestic buyers

- There are developments in the mountainous northern region mostly related to winter tourism resorts

- The property transfer tax is only 3%

- Property income is taxed at 9%

- Excellent opportunities in the vacation rental market

- Foreigners can own real estate, just as locals (except for land which needs to be bought via a company)

Montenegro in Numbers

| Indicator | Data |

|---|---|

| Population | 622,373 |

| Capital City | Podgorica |

| Administrative division | 23 municipalities |

| Income Category | Upper Middle Income |

| Currency in use | EURO € |

| GDP | $5.45 Billion |

| GDP per capita | $8226.60 |

| GDP per capita PPP | $17,238 |

| GDP growth 2019 | 4.7% |

| Unemployment Rate | 16.21% |

| Monthly Net Wages | 520€ |

| Credit Rating | B+ |

| Government debt to GDP | 62% |

| Corruption Rank | 66 out of 180 countries |

| Ease of Doing Business | 50 among 190 countries |

| Life Expectancy | 76.8 |

Treatment of Foreign Investors

The good news for foreigners wanting to invest in Montenegro is that they enjoy exactly the same freedoms as the domestic ones. They are allowed to fully own companies, buy land for development or agriculture, may invest in every industry, and free to transfer and distribute dividends and assets.

Montenegro’s Visa Regime

Visitors to Montenegro must obtain a visa from one of the Montenegrin diplomatic missions unless they come from one of the countries for which a visa is not needed. In case there is no embassy or consular representations of Montenegro, foreigners may obtain them from (depending on the country) diplomatic or consular representations of Serbia, Bulgaria, and Croatia.

Citizens and holders of passports of the following 97 countries and territories can enter Montenegro without a visa up to 90 days:

| Country |

|---|

| All EU citizens |

| Albania |

| Andorra |

| Antigua and Barbuda |

| Argentina |

| Australia |

| Azerbaijan |

| Bahamas |

| Barbados |

| Belarus (30 days) |

| Bosnia and Herzegovina |

| Brazil |

| Brunei |

| Canada |

| Chile |

| Colombia |

| Costa Rica |

| Cuba (30 days) |

| Dominica |

| Ecuador (30 days) |

| El Salvador |

| Georgia |

| Grenada |

| Guatemala |

| Hong Kong |

| Honduras |

| Iceland |

| Israel |

| Japan |

| Kosovo (30 days) |

| Kuwait |

| Liechtenstein |

| Macau |

| Malaysia |

| Mauritius |

| Mexico |

| Moldova |

| Monaco |

| Norway |

| New Zealand |

| Nicaragua |

| North Macedonia |

| Panama |

| Paraguay |

| Peru (30 days) |

| Qatar |

| Russia (30 days) |

| Samoa |

| Saint Kitts and Nevis |

| Saint Lucia |

| Saint Vincent and the Grenadines |

| San Marino |

| Serbia |

| Seychelles |

| Singapore |

| Malta |

| South Korea |

| Switzerland |

| Taiwan |

| Timor-Leste |

| Trinidad and Tobago |

| Turkey |

| Ukraine |

| United Arab Emirates |

| United States |

| Uruguay |

| Vanuatu |

| Vatican City |

| Venezuela |

Nationals of any country may visit Montenegro without a visa for up to 30 days if they hold a passport with visas issued by Ireland, a Schengen Area member state, the United Kingdom or the United States or if they are permanent residents of those countries. Residents of the United Arab Emirates do not require a visa for up to 10 days if they hold a return ticket and proof of accommodation.

Investment Incentives

Incentive measures at the national level include the tax incentives for investing, such as: exemption from corporate tax, taxes on personal income, the subsidies for employment of certain categories of unemployed persons.

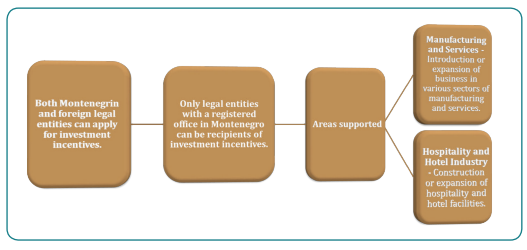

The government of Montenegro allows investors who implement investment projects that create jobs and further Montenegro’s economic development financial incentives. Both resident and non-resident legal entities can apply for investment incentives, but only entities with a registered office in Montenegro can receive them.

There is the possibility of an 8-year corporate income tax break for newly-established companies in the underdeveloped municipalities of Montenegro. These regions are mostly in its not so affluent North. The maximum amount a company can claim is 200.000 Euros.

So, if you as a taxpayer make a choice for these underdeveloped municipalities to place your production units in, you can become exempt from income tax for the first eight years.

Direct Investments

Montenegro’s direct investment incentive is supporting businesses that will employ at least 10 people in Montenegro’s North over the course of three years from the date of completing the investment contract and a minimum investment sum of 250,000€. An investment of 500,000€ and the employment of 20 people is required in the capital Podgorica and in the South of Montenegro.

For each newly-employed worker, you can claim between 3,000€ and 10,000€ in benefit money. from the State of Montenegro.

Note: As a beneficiary of incentive money, you need to keep the number of newly-employed workers steady for 3 years after completion of the project (Small and Medium-Sized Enterprises) and 5 years (Large Companies).

For large capital investments larger than 10 million Euros that will employ 50 workers or more, you can claim incentives of up to 17% of the total investment sum, without any scoring required. The costs of infrastructure investment related to the project can also be reimbursed.

Allocation of incentive benefits:

Business Zones

Business zones are organized structurally and formally in a way to facilitate the production and distribution of goods and services by offering a favorable investment climate. Companies are gathered in a distinct area that features modern infrastructure, access to utilities, and business services.

Additional tax and administrative benefits are available at the local and national level to increase production capcaity and exports. Companies in business zones also obtain easier credit lines with institutions for the development sector.

In a federal manner, the business zones are organized either at the state level (Business Zones of Strategic Importance) or municipal level (Business Zones of Local Importance)

Incentives are available both at the local and national level, local-level incentives include:

• Lower utility and other fees;

• Favourable lease/purchase options;

• Lower or zero surtax to PIT (Personal Income Tax);

• Lower real estate tax rate;

• Opportunity to define a favourable public-private partnership model;

National-level incentives eliminate compulsory social security contributions paid by the employer over the course of five years.

There are 9 Business Zones in Montenegro in: Berane, Bijelo Polje, Kolašin, Mojkovac, Cetinje, Nikšić, Podgorica, and Ulcinj.

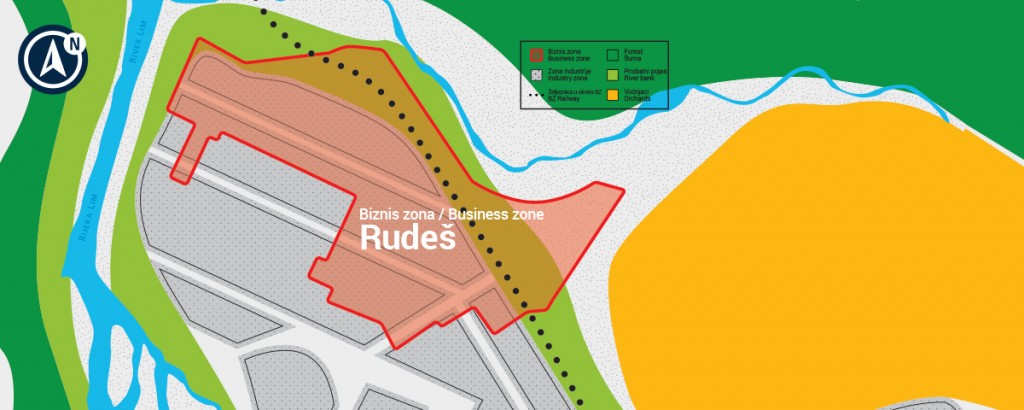

RUDES

Berane Municipality

Surface Area: 225 ha

Infrastructure: urban (industrial and drinkable) water supply system, electrical power supply and sewerage system

Purpose: brownfield and greenfield investments, commercial facilities, processing industry, manufacture, warehouses, distribution centers, service zones, commodity distribution center

The Business Zone “Rudes” is located along the Berane-Rozaje sectional road. Generally, the infrastructure network of municipal roads can be described as good.

This Business Zone is organized around the municipalities of Plav, Andrijevica, Bijelo Polje, Rozaje and Berane. Its main objective is to facilitate the investment climate for existing and start-up companies by giving active and technical support.

The following incentives are available to investors:

-

Exemption from mandatory social security contributions paid by businesses to employees.

-

8-year tax corporate income tax break for up to the amount of 200.000 €.

-

Exemption from municipal development costs for communal infrastructure.

-

Possibility to lease land for free during a period of 10 years given that new jobs are created

Up to 2,500 m2 → 3-5 jobs,

Up to 5,000 m2 → 6-10 jobs,

Up to 10,000 m2 → 11-20 jobs.

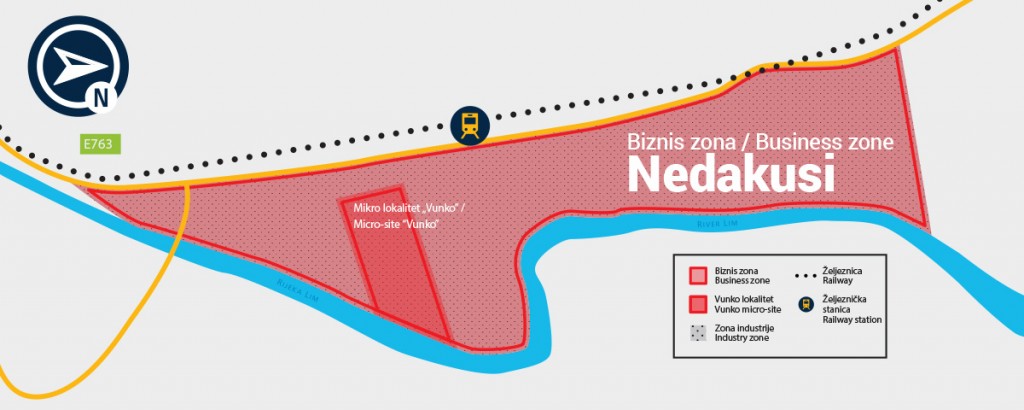

NEDAKUSI

Bijelo Polje Municipality

Surface Area: 250 ha

Infrastructure: two 2 MW substations, water supply, and sewerage system, public lighting, telecommunications

Purpose: brownfield (32,000 m2 occupied by existing plants) and greenfield investment – 32,000 m2 available and suitable for industry and production

The “Nedakusi” Business Zone is located right on the highway and railroad Beograd-Podgorica. Indeed, the railroad passes right next to the Business Zone. There are a railroad shipment center and bus station within the Zone.

The good traffic connection is a relic from the past, when this site was an industrious stronghold. The facilities, which consist of 9 production- and 2 administrative halls are still partially functional today.

More than 74,000 m2 of free land is suitable for industry and production capacity.

Here are your incentives:

-

exemption from payment of the fee for the use of municipal roads.

-

exemption from payment of the communal fee for construction land.

-

exemption from payment of surtax on personal income tax.

-

exemption from paying tax on real estate above 0.1% of the market value of the real estate.

-

The four exemptions stated above apply to the employers hiring at least 5 employees for a minimum period of 5 years.

-

Exemption from the contributions for mandatory social insurance of employees paid to the employees’ salaries.

-

Exemption from personal income tax and corporate income tax during the initial 8 years of operation if the tax amount is lower than € 200,000.

-

Exemption from municipal communal taxes.

-

Issuance of building permits within 7 days.

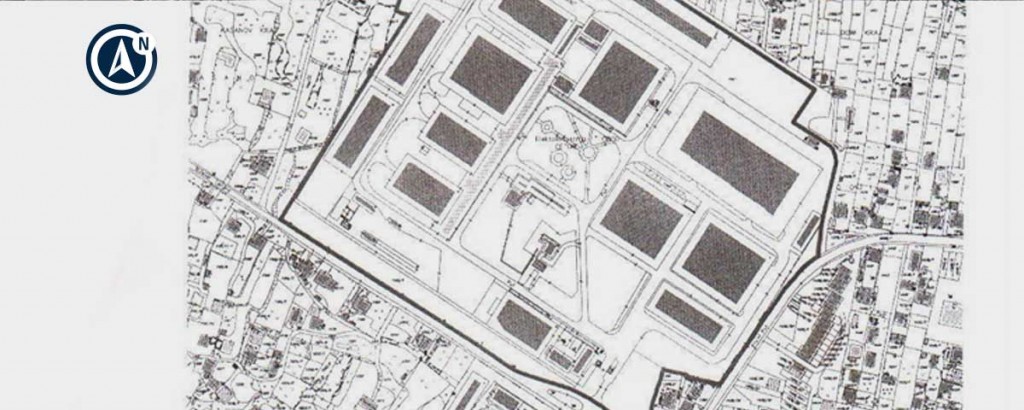

CETINJE I

Cetinje Municipality

Surface Area: 142 ha

Cetinje I Business Zone – Brownfield

The “Cetinje I” Business Zone is fully equipped with access to all municipal utilities: power and water supply, telecommunications, and eight 10/0.4kV substations.

The “Cetinje I” Business Zone is located on the site of an out-of-function industrial plant named “Obod” which stretches across 142 ha.

Investment incentives:

-

Exemption from payment of communal fees for construction land;

-

Exemption from real estate tax during the first 3 years of operation;

-

Assistance with administrative procedures at the local and national level;

-

Exemption from social security contributions paid on employee salaries;

-

Possible exemption from corporate income tax and personal income tax during the first 8 years of operation, up to €200,000;

-

Investment projects are eligible if the minimum investment value is €500,000 and if they generate at least 20 new jobs over a period of three years

-

Foreign investors in Montenegro enjoy identical treatment as locals. The 9% corporate and personal income tax rate is the lowest in the region;

-

Montenegro signed free trade agreements with the EU, CEFTA and EFTA countries, as well as Russia, Turkey, and Ukraine.

CETINJE II

Cetinje Municipality

Surface Area: 493 ha

Cetinje II Business Zone – Greenfield

The “Cetinje II” Business Zone is not yet fully equipped with access to municipal utilities. But soon, it will become suitable for Greenfield investments.

Note: The production of arms or anything that pollutes the environment is not allowed. The “Cetinje II” Business Zone is intended exclusively for greenfield investments.

This Business Zone is located on the main road from Budva to Podgorica, which enables connectivity towards both the inland and the coastal region of Montenegro.

Cetinje is:

- 29 km away from Budva,

- 31 km away from Podgorica,

- 37 km away from the Airport in Podgorica,

- 49km away from Tivat’s Airport,

- and 67km away from the Port of Bar.

Overview of business incentives:

-

-

Exemption from payment of communal fees for construction land;

-

Exemption from real estate tax during the first 3 years of operation;

-

Assistance with administrative procedures at the local and national level;

-

Exemption from social security contributions paid on employee salaries;

-

Possible exemption from corporate income tax and personal income tax during the first 8 years of operation, up to €200,000.

-

BAKOVICI

Kolasin Municipality

Surface Area: 131 ha

Infrastructure: overhead 10 kV power line; possibility to connect to the power supply grid, the water supply system, the telecommunications system, and the Internet.

Purpose: Greenfield investment, industry, and production

The site of the Business Zone “Bakovici” is unoccupied, relatively undeveloped, and without the infrastructure in place. It is located in Kolasin’s industrial zone, 4 km away from the town center, on the Bar-Belgrade motorway. There is access to a railway station (5km).

-

Exemption from the contributions for mandatory social insurance of employees.

-

Exemption from personal income tax and corporate income tax for the first 8 years of operation, if the tax amount is lower than € 200,000.

-

Exemption from real estate tax for a period of 8 years from the date of commencement of business activity.

-

Exemption from payment of communal fee for construction land.

-

Landlease up to 30 years.

BABICA POLJE

Mojkovac Municipality

Surface Area: 84 ha

Infrastructure: power supply, possibility to connect to the water supply system, public lighting, and telecommunication systems

Purpose: greenfield zone; commercial, service and production facilities

The Business Zone “Babica Polje” is currently in the phase of being infrastructurally developed. Urban planners are installing water and sewerage systems, electric installations, and telecommunications.

Babica Polje is located only 2 km away from the city center of Mojkovac. The main road to Podgorica and the railroad to the Port of Bar are in close distance. The Business Zone has excellent connectivity with other countries in the region: Serbia, Bosnia and Herzegovina, Croatia, and Albania.

Available natural resources are arable land, the hydropower potential of the Tara River; biomass for pellets; forest reserves; lead and zinc mines.

Investment incentives:

-

Land lease at 0.05 €/m² for production and wholesale.

-

Exemption from the fee for municipal communal infrastructure on construction land for the investors hiring more than 10 employees.

-

The fee for communal infrastructure on construction land is reduced by 85% for investors hiring 6-10 employees.

-

Reduction of the fee for construction land if 3–5 workers get employed.

-

Reduction of real estate taxes by 80%

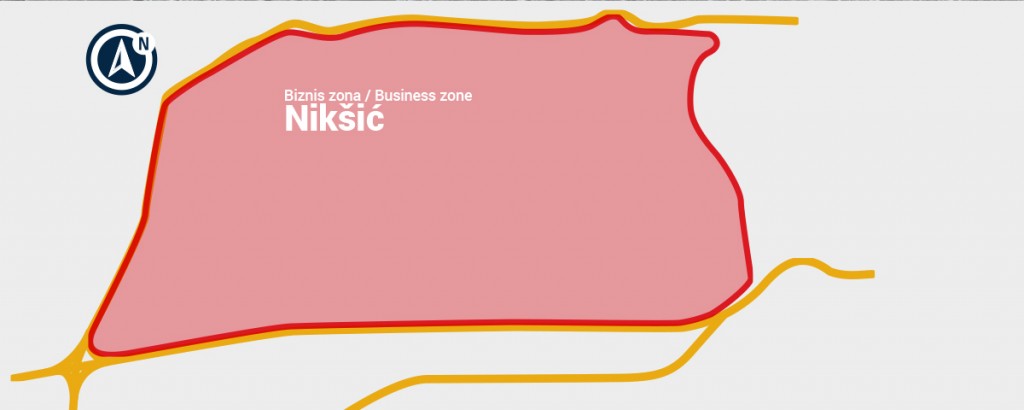

NIKSIC

Niksic Municipality

Surface Area: 101 ha

Infrastructure: wastewater treatment system; water supply, and sewerage system, power supply

Purpose: Greenfield/Brownfield

The Business Center “Niksic” is centrally located within Montenegro and well-connected to its neighboring countries. It is part of the European road network through the “E-762” international road.

This Business Zone makes use of the remainders of a former factory. It features access to the regular railway and industrial siding; there is adequate infrastructure as well as the potential for expansion further to the west.

Niksic’s Municipal Strategic Development Plan has identified the following key drivers of development: metal processing, engineering industry, minerals, agriculture, wood processing, and the food industry.

Investors have incentives in the form of:

-

Exemption from the mandatory social security contributions paid to employees.

-

Exemption from personal income tax and corporate income tax during the first 8 years of operation, if the tax amount is below € 200,000.

-

Reduction of the fees for communal infrastructure by 50%

-

Reduction of real estate taxes by 70%

-

Exemption from the surtax on personal income.

KAP INDUSTRIAL

Podgorica Municipality

Surface Area: 280 ha

Excellent infrastructure and access to utilities (access road; power, water supply, and sewerage systems; public lighting; postal and telecommunications services).

The Business Zone comprises the existing facilities of the Podgorica Aluminum Plant (KAP).

The following activities are eligible for the Business Zone:

-

Transport and logistics;

-

Light industry and processing industry;

-

Storage and wholesale;

-

Food processing industry;

-

Services;

-

ICT.

Investment incentives:

-

70% reduction in the municipal utility fees for new developments;

-

Building permits issued within 30 days;

-

Inexpensive 49-year lease; potential investors are required to hire a specific number of employees, namely:

– 6-10 employees when using a land plot of up to 2,500m2;

– 11-20 employees when using a land plot of up to 5,000 m2;

– 20‐30 employees when using a land plot of up to 10,000 m2;

– 30+ employees when using a land plot larger than 10,000 m2.

-

Real-estate tax exemption over a period of 5 years;

-

Exemption from the surtax on personal income tax over a period of 5 years;

-

No VAT or customs duties payable for the export products, in line with the VAT Law;

-

Exemption from payment of social security contributions to employee salaries;

-

Possible exemption from corporate income tax and personal income tax during the first 8 years of operation, if the amount due is lower than €200,000;

VLADIMIRSKE KRUTE

Ulcinj Municipality

Surface Area: 255 ha

Infrastructure: overhead 110/35 kV power line; possibility to connect to the power supply grid, water supply system

Land Lease from 0,10€ to 0,50€ per m².

-

No fees for municipal communal infrastructure

-

Reduction in the real estate tax during the first 8 years

-

Exemption from the surtax on personal income tax.

Free Economic Zones and Warehouses

In 2004, Montenegro adopted the Law on Free Zones, which offers investors benefits and exemptions from custom duties, taxes, and other duties in specified free-trade zones. Any goods entered into a free zone or warehouse that are used or consumed in line with the Law are exempt from customs duties, customs charges, and VAT. The Port of Adria in Bar is currently the only free-trade zone in Montenegro.

Port of Adria Free Zone

The free-trade zone “Port of Adria” is compromised by the Container-, General Cargo-, and Timber Terminals of the port. The entire area of the “Port of Adria” is under the Free Zone regime, which enables exemption from customs duties, taxes, and other duties.

Free Zone Advantages:

-

All legal economic activities allowed (except those that: jeopardize the environment, people’s health, material goods, and soil-safety)

-

Foreign investors have equal rights as local ones in regards to property rights and business conditions

-

Long-term lease options with fixed conditions

-

Customs, customs duties, and value-added tax is not paid for imported goods and goods can stay there indefinitely

-

The goods can be temporarily taken out of the Free Zone or taken in to be processed, installed, tested, surveyed, repaired, and presented.

-

Goods dispatched to the territory of Montenegro are subject to customs, customs duties, and VAT at the moment of leaving the Zone. Customs and customs duties are paid only on foreign components of the goods.

-

Zone users are free of paying corporate income tax (CIT)

-

Reinvesting capital within the Zone and transferring of profits is free

Subsidies for the employment of certain categories of unemployed persons

There are also subsidies for the hiring of unemployed persons and persons with disabilities. Subsidies are available to anyone that hires:

- anyone older than 50 years

- a single person with one more more dependants

- anyone out of work for the past 6 months

- anyone who did not complete secondary education

- anyone who completed regular schooling and did not find employment within two years

- members of the Roma and Egyptian population

- anyone participating in public work schemes.

Employers can claim benefits for a maximum of 12 months and will be free from the mandatory social contributions paid to the state, including the tax on personal income.

Cluster Development Program

Through the Ministry of Economy, there is a cluster development program in place which is directed towards groups of companies that all have similar business activities. The Ministry is subsidizing capital investment into equipment with 50% – 65% of its total value (65% for investments into less-developed regions). The minimum amount per applicant is €10,000 and the maximum amount €500,000. In line with the reimbursement scheme, the enterprise covers 100% of all the costs of the purchase of equipment in question and get reimbursed upon submitting relevant documents.

Activities allowed under this scheme are:

- Agricultural production and processing,

- Wood processing,

- Other manufacturing activities

The Investment and Development Fund of Montenegro is implementing this Programme through direct

loans.

- The maximum amount is €500,000

- The minimum amount is €10,000;

- Repayment term of 8 years (incl. grace period);

- Grace period of up to 2 years.

Programme to enhance Regional and Local Competitiveness

This Program is also directed towards entrepreneurs, SMEs, and clusters of SMEs, especially in less-developed municipalities. The goal of the program is to increase competitiveness through harmonization with international standards. The Programm is supporting companies by:

1) Reimbursing the accreditation costs

2) Reimbursing the standard implementation/

certification/re-certification costs.

The Ministry of Economy is subsidizing amounts up to 70% of total investment costs for entrepreneurs and small enterprises and 60% for medium-sized companies.

The maximum amount is €5,000.

Program to enhance innovation in SMEs

This Program wants to improve Montenegro’s innovative potential through establishment of research institutions, technology parks, centers of excellence, business incubators, and consultancy companies. This scheme reimburses 50% of consultancy costs up to an amount of 2500 Euros.

VAT incentives

There are VAT incentives (0% VAT rate) for investors in the following sectors: high-end tourism (hotels and condo hotels with 5 or more stars), food production (>500,000€ investment), and investments in the energy sector (>10MW).

International Agreements

The signed bilateral agreements enable the investors who decide to do business in Montenegro to export their products to a market of more than 800 million people.

Economic Cooperation Agreements

Romania, Austria, Bulgaria, China, Hungary, Qatar, Serbia, Turkey, North Macedonia, Slovenia, Greece, Croatia, Germany, Spain, Azerbaijan, United Arab Emirates, Czech

Republic, Slovakia, Albania, and Argentina.

Free Trade Agreements (FTAs)

Montenegro has FTAs with the following countries:

- Russian Federation

- CEFTA – Central European Free Trade Agreement,

- Turkey

- Ukraine

- EFTA states