How to Open a Bank Account in Montenegro

Opening a bank account in Montenegro has undoubtedly become more challenging in recent years. Most banks follow strict due diligence procedures and may even refuse account openings for certain nationalities—for example, if the applicant’s country is on the UN sanctions list. However, it is no problem for anyone with a western background to get a Montenegrin bank account if all requirements are fulfilled.

Opening a Bank Account in Montenegro as a Non-Resident

It is not possible to open a bank account in Montenegro as a non-resident. If you want to open an account, you would need to get a residence permit or purchase a property first.

Opening a Personal Bank Account in Montenegro

You can open a personal bank account in Montenegro if you either own property or hold a residence permit. The required documents are as follows

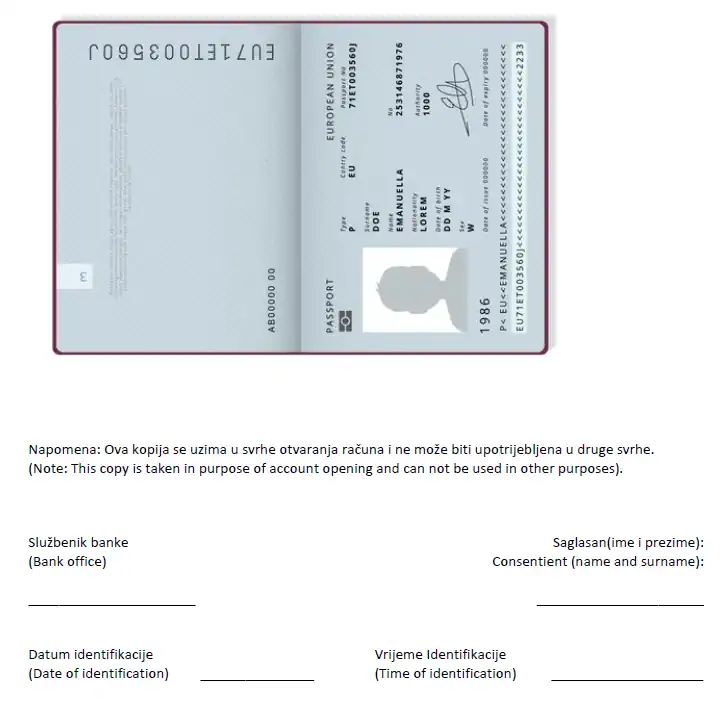

- A valid passport (copy)

- Proof of accommodation in Montenegro (either property title or lease agreement)

- Montenegrin residence permit (copy)

- Employment contract (copy)

- Proof of address from the home country (e.g. recent utility bill, tax bill, or another official government-issued document showing the address)

The account opening process takes roughly half an hour. During this time, the bank employee will ask you to provide personal details such as your father’s given name, phone number, and e-mail address. The bank officer will then scan your passport, and you will be asked to provide your signature on the copy.

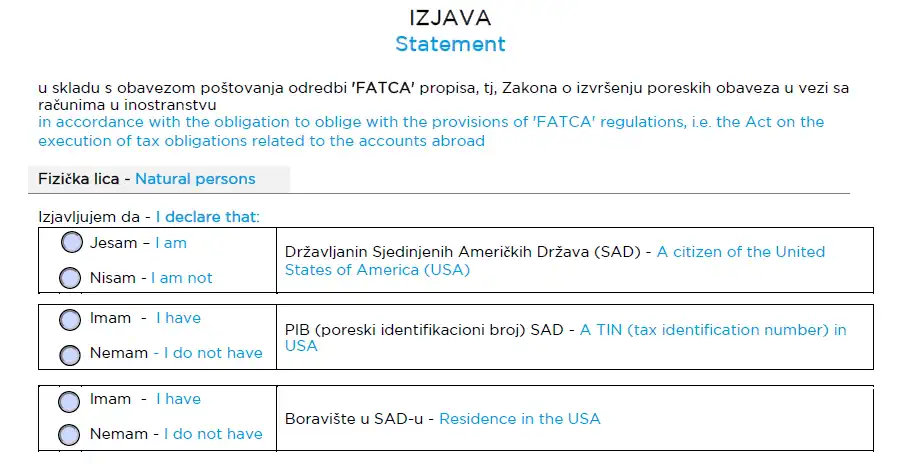

The next step in the due diligence procedure is signing the FATCA and PEP forms. FATCA (Foreign Account Tax Compliance Act) requires foreign financial institutions (including Montenegrin banks) to collect and report data on U.S. citizens abroad who open bank accounts.

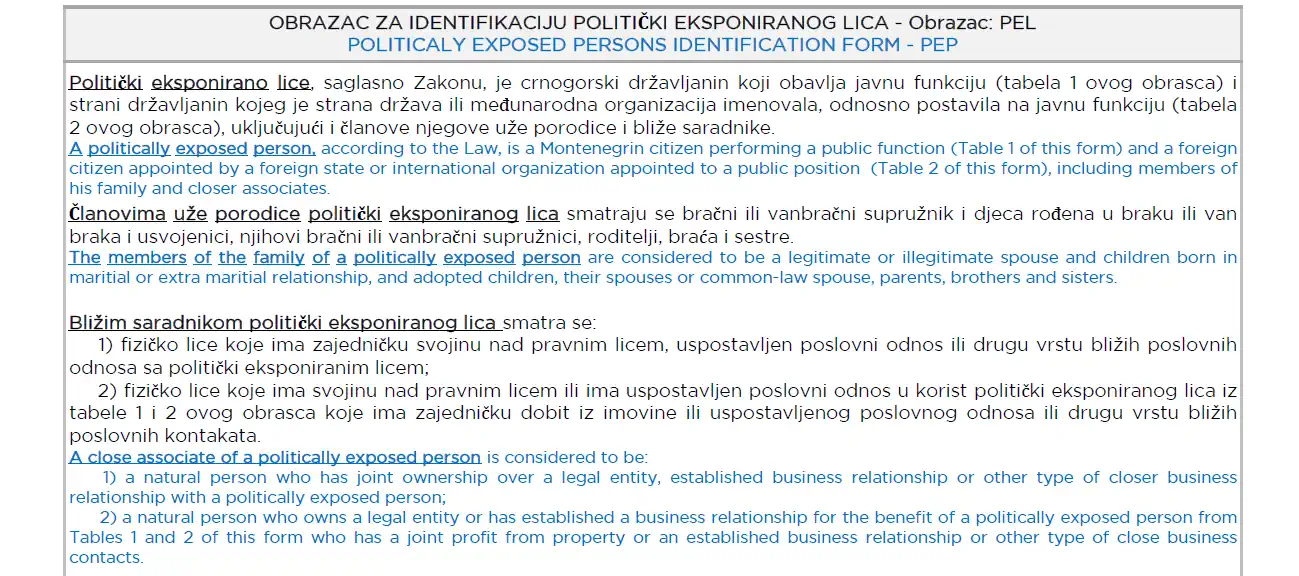

The Politically Exposed Person (PEP) Identification Form collects information on individuals in Montenegro who hold prominent public functions, such as politicians, diplomats, or senior government officials.

Most banks provide debit cards, mobile banking, and e-banking services, but you must request each option separately. The personal account application form will ask about your employment status, financial details, and whether you expect any large transactions in the near future. You should receive your bank card and mobile banking access code within a few days.

Opening a Business Bank Account in Montenegro

You can open a business bank account once you have obtained residency in Montenegro and are ready to start receiving or making payments for your company. Every company in Montenegro (e.g., limited company, sole trader) is required to maintain a local bank account for processing employee salaries and paying taxes. Opening a corporate bank account is subject to a stricter due diligence procedure. The required documents are:

- Signed copy of your passport

- Copy of your national ID card (or Montenegrin residence permit)

- Proof of current residential address (e.g., certified rental contract)

- Certificate of Incorporation

- Articles of Association (copy)

- Memorandum of Association (copy)

- Recent extract from Montenegro’s Company Register (issued within the last 3 months)

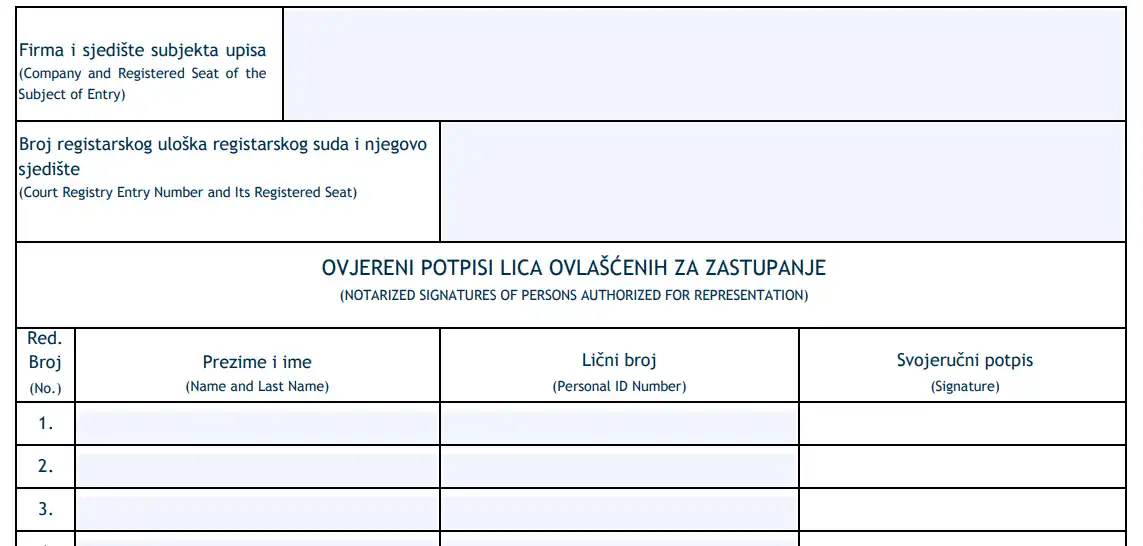

- Signed list of authorized signatories and accounts

In addition, the document known as the ‘OP Obrazac‘ in Montenegrin must be signed by the company director and certified by a Montenegrin notary.

A known challenge with some Montenegrin banks is that they do not automatically accept all businesses. If your company is registered for a business activity deemed high-risk (e.g., consulting services), your application may be rejected.

This is a major drawback of attempting to open a bank account on your own. Our in-person introductory service is included in our higher-tier company formation packages. We have a network of partner banks that we closely cooperate with, and depending on your individual needs, we can provide a tailored solution for you.

Info: To open a bank account in Montenegro, we must schedule a meeting with a banking representative, and you are required to visit the local branch in person. Unfortunately, opening accounts remotely in Montenegro is not possible.

Need help with opening a personal or business bank account?

Open your account today with adriacom. Quick, simple, and affordable.

– or –

Frequently Asked Questions

Montenegro’s banking sector is stable, and banks are conservatively managed. All banks are legally required to provide deposit insurance protection to both individuals (resident or non-resident) and Montenegrin companies, on all account types, including checking, current, and savings accounts.

In the event of a bank bankruptcy, the Deposit Protection Fund (Fond za zaštitu depozita) guarantees payouts of up to 50,000€ per depositor. For balances exceeding 50,000€, depositors may receive the remaining amount from the bank’s bankruptcy estate.

Tourists are considered non-residents in Montenegro and thus cannot open a bank account. To do so, they must first obtain temporary residency, which can be granted for reasons such as starting a business in Montenegro, purchasing real estate, mooring a yacht in a marina, or any other valid purpose.

Opening a bank account in Montenegro requires your physical presence to complete the account opening process, as only certain steps can be done online. For example, with Erste Bank, you can first fill out an online form with your personal and contact details. A bank employee will then contact you by phone to verify the information.

Once your application is processed, you must visit a bank branch in person to sign the documents and collect your bank card.

You may face difficulties opening a bank account if your country of origin is blacklisted by the Central Bank of Montenegro or by the bank’s internal compliance department. Only a few countries find themselves on the list, including:

- Iran

- Syria

- Afghanistan

- Pakistan

- Cuba

Each bank has its own internal policy and can decide which nationalities it considers acceptable. That said, some banks may not accept Russian or Chinese nationals, while others may allow them. Broadly speaking, nationals of European countries, the UK, Canada, Australia, New Zealand, the United States, and similar countries rarely face any issues when opening a bank account.

To send money to a Montenegrin bank account, you need to request the recipient’s international bank account details, which include:

- Name of the account holder (full name or company name)

- International Bank Account Number (IBAN)

- SWIFT/BIC code

- Payment reference (e.g., “Invoice nr. 1234” or “Gift to relative”)

- Bank address and the account holder’s personal or corporate address

Most banks in Montenegro are international, universal banks with local branches, while a few are fully Montenegrin, such as Prva Banka Crne Gore (First Bank of Montenegro) and Lovcen Banka. Many of these banks offer e-banking, debit and credit cards, mobile banking, and contactless payment solutions.

However, not all banks provide mortgages or business loans to temporary residents, and some provide private banking services for high-net-worth clients. Discover our full guide to the best banks in Montenegro here.