Table of Contents

ToggleOverview of the Montenegro Economy of 2023

Despite the challenging macroeconomic environment in 2022, Montenegro’s economy showed strong domestic demand and private Investment.

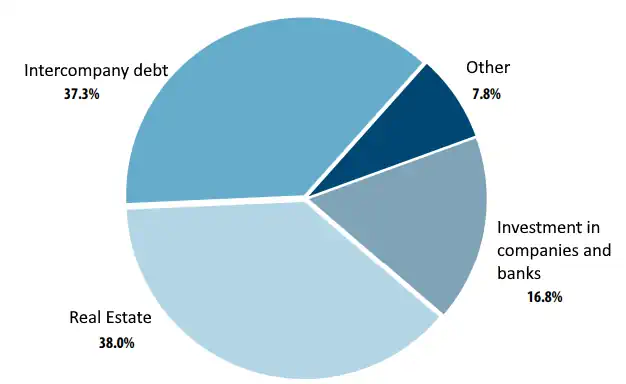

The previous year has seen a net inflow of 782,63 million Euros in foreign investment, 34.5% more than in the previous year. A significant share (448 million Euros) flew into the real estate market while another 219 million was invested in companies and banks.

The latest data from the World Bank Group predicts 6.9% growth for the Montenegrin economy.

Montenegro Economy Type

Montenegro has a service-based market economy. Prices of goods and services are the result of market demand and supply. Montenegro has been a member of the Central European Free Trade Agreement (CEFTA) since 2007 and is defined as an upper-middle-income country by the World Bank.

Economies that fall into this category are those with a GNI per capita between $4,256 and $13,205. Montenegro’s GNI per capita was $9,340 in 2021. Montenegro is particularly vulnerable to external shocks, relying heavily on foreign capital flows from abroad to stimulate its economic growth.

Montenegro Economy Ranking

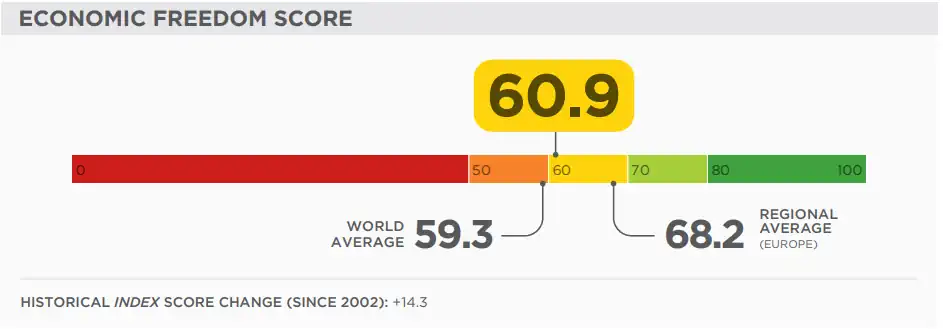

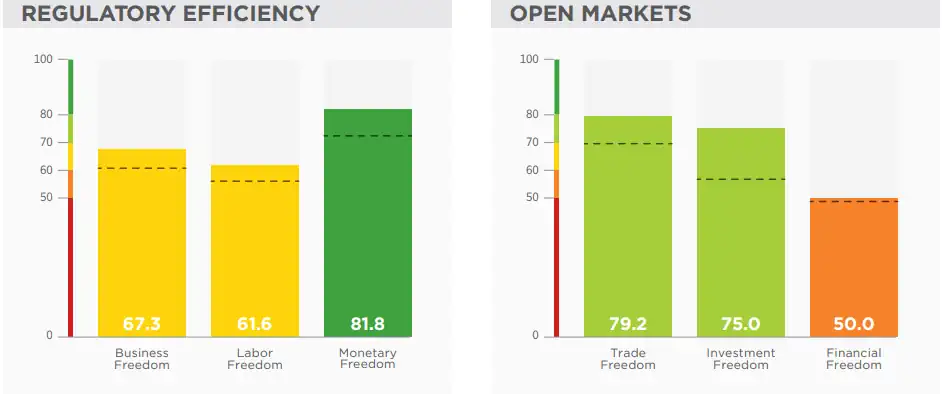

source: Heritage Foundation

According to the Heritage 2023 Index of Economic Freedom, the Montenegrin economy is ranked 77th place with a score of 60.9, up 3.1 points from last year’s ranking.

As can be seen from the graphs above, the results for property rights and especially for the tax burden in Montenegro are good.

Where Montenegro lacks is fiscal health, government integrity, judicial effectiveness, and especially government spending which is ranked significantly below the world average. The public debt to GDP ratio currently stands at 74.41%.

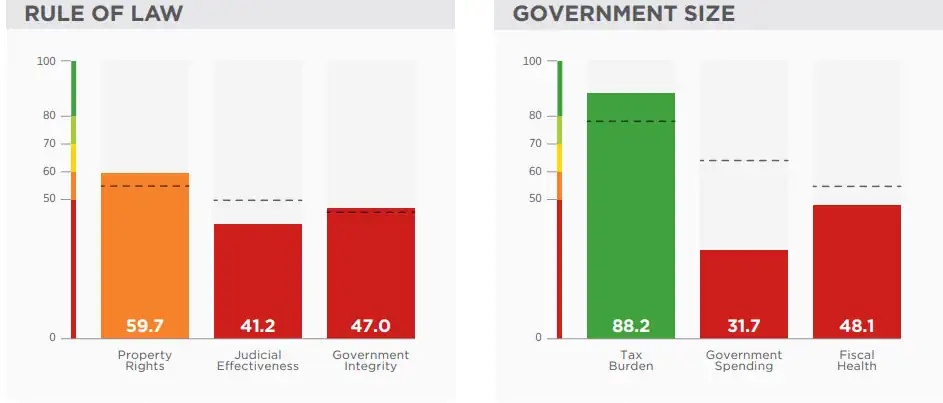

source: Statista

Government spending as a percent of GDP is elevated at roughly 20%. It has a similar value to Italy’s, a country that is not known for fiscal discipline. Public finances have been strained by a plethora of social spending programs such as the elimination of public healthcare contributions in early 2022.

Public debt to GDP levels went beyond 100% in 2020 during the Covid-19 pandemic but decreased to about 70% in 2023.

The fiscal deficit for 2023 is projected to be around 5% of GDP and will remain elevated for some time.

Economic growth in Montenegro is generally supported by solid business, monetary, and trade freedoms. The procedures to form companies in Montenegro have been streamlined in recent years.

The banking sector is characterized by the presence of many international banks that foster economic development but are limited somewhat by government regulation. Financial freedom is measured by looking at the following indicators:

- Degree of government regulation and interference in the financial sector

- Government influence on credit allocation

- Degree of capital market development

- Openness to foreign competition

What we can see from the ranking results above is that labor freedom is only average since regulations are often inflexible and need improvement.

Fraser Institute Economic Freedom Ranking

The Montenegrin economy ranks slightly better in another popular economic freedom index which is released by the Fraser Institute.

source: Fraser Institute

According to the Fraser Institute, Montenegro is in the highest category of the ‘Most Free’ countries due to its sound money policy and relatively efficient regulatory framework. The subcategory ‘size of the government’ received a bad rating as in the previous freedom index.

Montenegro GDP (per capita)

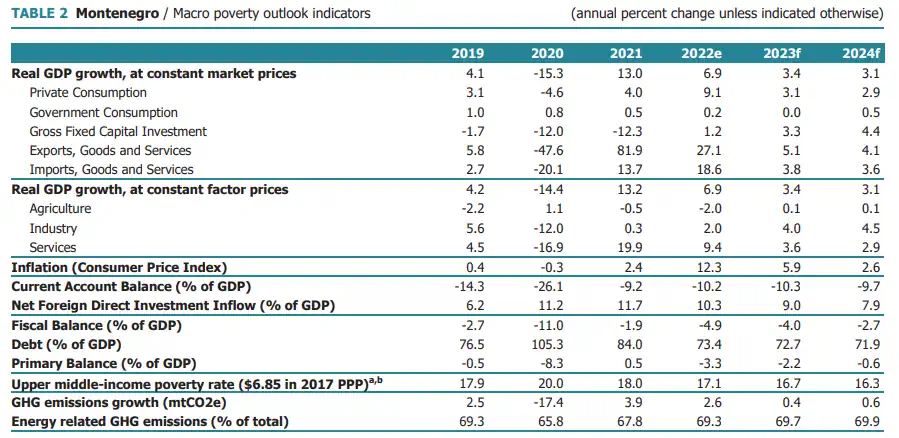

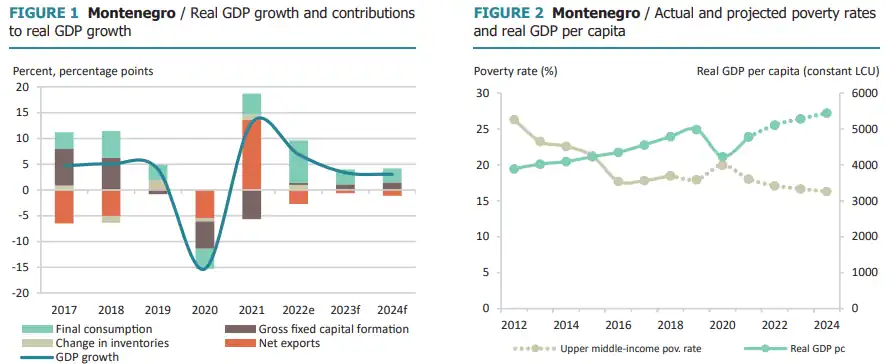

The annual GDP data has not been released yet but the World Bank has estimated a 6.9% growth for Montenegro’s economy, led by private consumption and the fast-growing tourism sector.

The World Bank has revised the data for the years 2020 and 2021 where the country’s economy grew by minus 15.3% and 12.4% respectively. The Real GDP in 2023 will surpass 6 billion USD which is equivalent to roughly 10,000 EUR/USD per capita, 48% of the European Union average.

Compared to Serbia and Albania (two countries Montenegro shares borders with), 4% and 16% more respectively. It is estimated that the real GDP is more than 20% higher due to a rather big share of the grey economy.

The International Monetary Fund projects a Real GDP rate of 2.5% for 2023 while the World Bank forecasts 3.1%.

source: World Bank

Montenegro is a small but open economy attracting foreign investors who are mostly engaging in development projects at the coast or in the economic sectors of energy production and agriculture. The share of agriculture in Montenegro’s GDP is about 6.5% according to the Central Bank whereas agricultural land accounts for roughly 35 percent of the total land in this mountainous country.

From 2009 to 2019 the World Bank contributed to an agriculture-strengthening project, by which the food safety system was brought in alliance with EU standards, a border inspection post was established in the city of Bar, and an electronic farm register was created.

What is the main economy of Montenegro?

Following its independence from the state union with Serbia in 2006, Montenegro went ahead to join the World Trade Organization (WTO) in 2012 and NATO in 2017. Accession negotiations with the EU are progressing and Montenegro has no open issues with its neighbors.

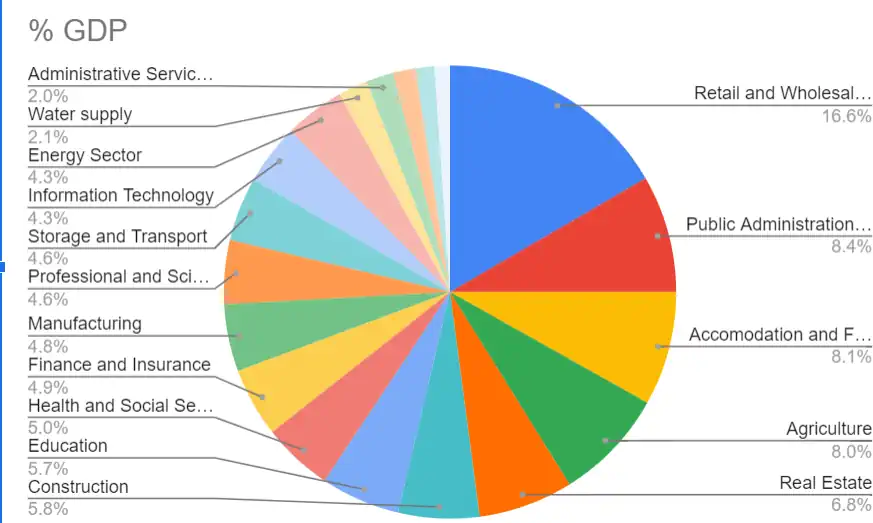

If we look at the composition of Montenegro’s Gross Domestic Product, we can see that is rather diversified. The following sectors dominate:

- Trade (Retail and Wholesale)

- Accommodation and Food

- Agriculture

- Real Estate

- Construction

Taken together, the service sector makes up about 70% of the GDP and employs three-quarters of the Montenegrin population. Tourism on its own contributes between 20% and 25% to GDP. Further, consumption has a large share of Montenegro’s economy which imports five times more than it exports.

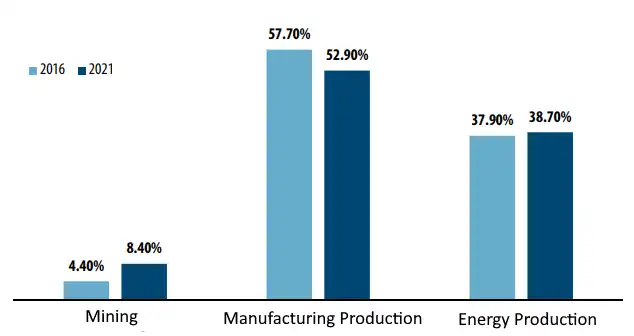

The industrial sector is characterized by a growing share of energy production and mining and a simultaneously receding manufacturing sector which still has the largest share in industrial production at 52.90%.

Within the manufacturing industries, nine categories experienced a surge in production levels:

- Paper and paper products +137%

- Plastic and rubber products +112%

- Furniture +81%

- Pharmaceutical products +73%

- Audio and Video recordings +70%

- Food products +27%

- Metals +24%

- Machines and spare parts +6%

- Beverages +2%

To stimulate new investments, the Government of Montenegro has defined three essential pillars of its economy that they support with incentives: upscale tourism, energy, and food production/agriculture.

You can read more about the sectors further down this article.

Foreign Direct Investments Montenegro (FDI)

Over the last five years, foreign direct investments in Montenegro had a share of 16.8% of the country’s GDP. Most of them came in the form of either intercompany debt (37.3%) or real estate investment (38% share).

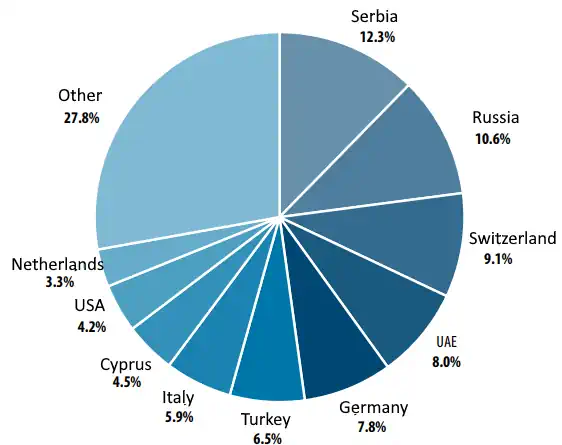

Where do the FDIs come from mostly?

What we can see from the graphic below is that for the year 2022 Serbia, Russia, Switzerland, UAE, and Germany were the biggest foreign investors in Montenegro. Germans were the single largest investor in real estate with 51.6 million Euros out of a total of 322 million, followed by Russians and Serbs.

Inflation in Montenegro

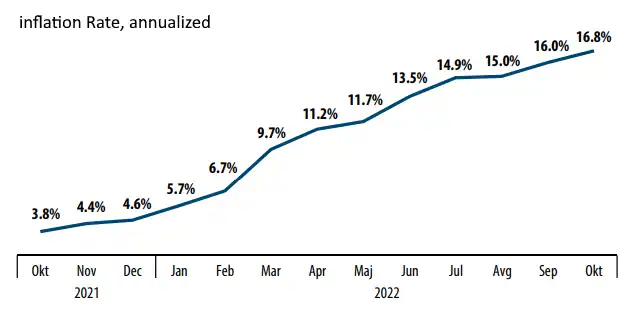

Due to the supply chain disruptions and ensuing industrial limited capacity in the aftermath of the Covid-19 epidemic and ongoing war in Ukraine, inflationary pressure and price levels remain high worldwide.

Montenegro is no different.

source: Montenegro Statistics

The annual inflation rate in 2022 amounts to 12.76% on average but is higher for most products in private consumption:

- Milk, cheese, eggs: 47%

- Bread: 30%

- Rentals: 30%

- Vegetables and fruits 28%

- Sugar and sugary products 23%

- Meat and vegetable oil 21%

- Food and Beverages (not including alcohol) 29%

- Water and electricity 16%

- Hotel and Accommodation 26%

- Transport 12%

- Textiles 12%

- Fuel 11%

The Central Bank of Montenegro with no currency of its own has no monetary tools at its disposal to reign in inflation on its own. Potential price increases can only be fought by undertaking structural economic reforms. These reforms need to be aimed at expanding the general level of productivity and competitiveness.

Speaking about productivity, Montenegro’s public sector is bloated, highly inefficient, and desperately needs reforms. Many employees are put in function out of political reasons rather than merit. This did not hinder them to raise their average salaries by 30% just a couple of weeks ago.

Unemployment Rate Montenegro

At the end of 2022, 46.596 Montenegrins have been without work, 58% of which are women. This translates to roughly 17% of the total labor force, 18.27% less than the year before.

The latest available data suggests that the basic economic needs of one-third of the country’s population are not met and that not everyone has access to equal economic opportunity. Shared prosperity is not transmitted to the northern region of Montenegro which can easily be seen by looking at the employment data below:

- Kotor has the least unemployed persons with only 1 in 71 looking for work

- in Herceg Novi it is 1 in 50

- in Tivat 1 in 38

- in Podgorica 1 in 23 is without work

- In Niksic one in 14

- In Plav and Rozaje 1 in 4

The new Montenegrin government has undertaken a tax reform at the start of 2022 which resulted in a surge of the average wage to 722,00 Euros per month, 35 percentage points higher than in the last year. The average gross wage is 892 Euros now.

The minimum wage has been simultaneously increased to 450 Euros, increasing average household spending countrywide. The formerly ruling Democratic Party of Socialists has criticized this move as an action that would put a strain on public finances and the business climate.

The Montenegrin Employers Federation and the Chamber of Commerce have been warning for years that there was a divergence between what businesses ask for in graduates and what the universities can provide.

This mismatch contributes to a situation where the private sector actively tries to engage in political dialogue and policymaking.

Montenegro Economy Tourism

Montenegro is one of the fastest-growing tourism markets in the world with more than 2 million tourist arrivals in 2022. Prime Minister Abazovic announced a yearly revenue from tourism of almost one billion Euros which constitutes 275 million more than in 2021.

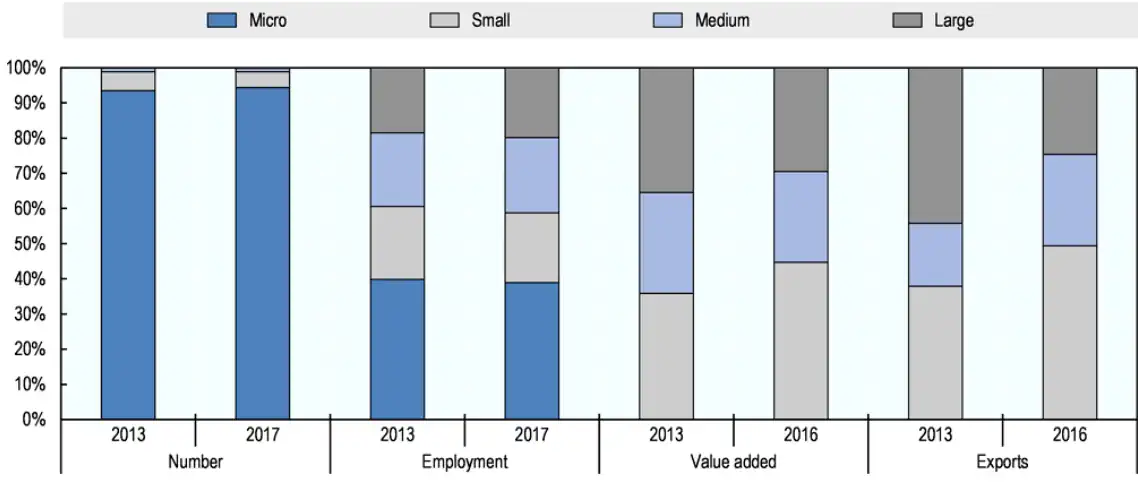

Montenegro’s private sector is made up of mostly micro and small enterprises that are dependent on tourism, at least indirectly.

source: OECD

Montenegrin legal entities break down into 94.4% micro-enterprises, 4.5% small enterprises, 0.9% medium-sized enterprises, and just 0.2% large enterprises. Large and medium-sized enterprises though are responsible for 20-25% of total employment, Value Added, and Exports.

Montenegro has a rather diverse tourism offering with its coastal region serving mostly as a beach holiday destination whereas its lush and mountainous North receives many nature enthusiasts and in winter also skiers.

In 2022, tourists mainly arrived from:

- Serbia 25.5%

- Russia 16.4%

- Bosnia 9.9%

- Germany 5.9%

- Ukraine 4.9%

- Kosovo 4.0%

- United Kingdom 3.3%

Montenegro was ranked as the second fastest-growing tourism market in the world.

Coastal and Marine Tourism

About 80% of all tourism in Montenegro is concentrated along its 293km long beautiful Adriatic Coast. Beach holidays and water activities like swimming, diving, and sports fishing, make up a total of 94% of tourist arrivals.

The market is focused largely on hotels and resort holidays along the coast. Montenegro is trying to position itself as an upscale destination and move away from cheap package tourism that dominated the last three decades.

Luxury Marinas

Within the last 10 – 15 years, three Luxury Marinas have opened their gates to affluent international investors and yacht owners. It is not hard to see why they have earned international acclaim. Montenegro is blessed with one of the most beautiful coastlines in the world.

Dramatic mountain ranges meet the crystal clear water of the Mediterranean, with a topography similar to France’s southern coast.

Porto Montenegro is a 238-berth-counting marina for super yachts (i.e. yachts that are huge and cannot find berths just anywhere). One could argue that this 500 million Euro development project was the trigger for many hotel and real estate investments that followed suit closely after.

Tivat, the resort town where the marina is located, is today a popular destination for tourists and ex-pats alike. With Portonovi and Lustica Bay, Montenegro has already three upscale marinas in its portfolio.

Mountain and Rural Tourism

Mountain resorts received only 2.0% of the 2.2 million tourists that visited in 2022. That is why the Montenegrin government is busy working trying to attract a broader traveler base who are interested in rural and eco-tourism.

Many visitors to Montenegro underestimate this country’s geographic diversity with its stunning glacial lakes, green pastures, and countless mountain trails and forests.

Rural development and branding of its local farm and food produce have been defined as one of the top priorities of the current government.

Ski Tourism

Montenegro does not sound like a winter and skiing destination – yet. This is probably going to change soon with the development of a large-scale ski resort in Kolasin that will measure 250 kilometers of pistes once finished.

Largely stimulated by a dozen or so four- and five-star-hotel developments of the now-canceled Citizenship-by-Investment Program, Kolasin has quickly become one of the best ski resorts in this part of Europe.

Local hotel operators joined forces with major international brands to improve the existing offer manyfold. Once in full capacity, this ski center is expected to be a major driver of local job creation and employ at least 1,000 workers.

The Agricultural and Food Sectors in Montenegro

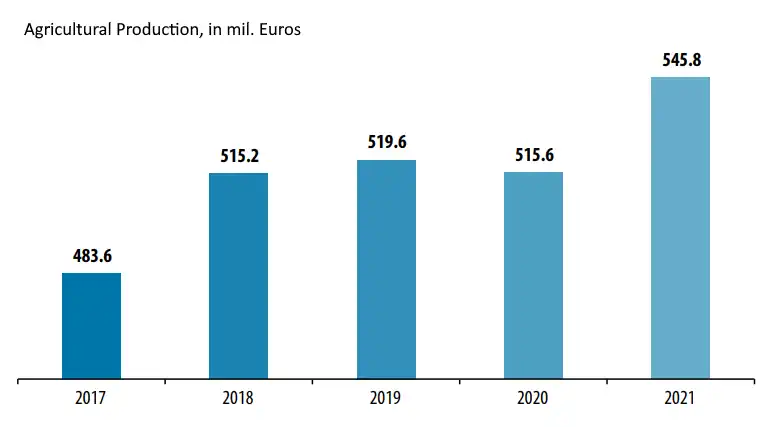

Besides tourism, the agricultural and food-producing sector is one of Montenegro’s most strategic assets, making up 6.5% of GDP in 2022. The total value of food production amounted to over 550 million in 2022, growing about 5% per year.

Given that more than 48,000 households depend on the agricultural sector to earn a full or part-time income, the importance it has on employment levels can easily be understood.

source: Montstat

Agriculture as a whole contributes to rural development and is crucial when it comes to fighting rural exodus, and preserving the cultural heritage and historic importance of the village as an institution.

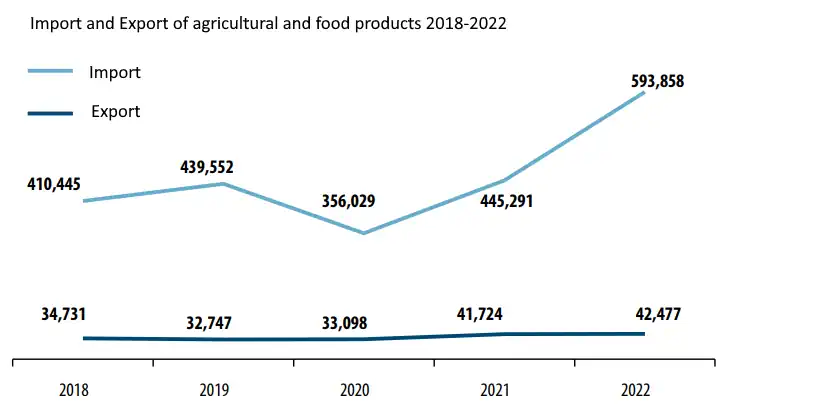

One major problem the agricultural sector in Montenegro has to face is the weak export performance of its products. Food imports have been more than ten times exports in 2022. As in previous years, the list of imported products by order of magnitude includes:

- Meat

- Beverages

- Soups, Sauces, and Ketchup

- Milk and Milk produces

- Fruits and Vegetables

- Wheat and cereals

The increase in the value of imports in 2021 and 2022 which we can see in the graph below is also due to a general increase in the price level of these products.

In terms of exported products, smoked and dried meat products top the list followed by beverages, fruits and vegetables, mushrooms, and etheric oils.

Forestry

Forests in Montenegro extend on a surface larger than 800k hectares, covering more than half the country in trees. The total wood volume is estimated to be 122 million m3, growing annually by 2.4% (2.9 million m3).

The Government of Montenegro allows its concessionaries to cut down 800k m3 per year in total (650k m3 in state-owned forests and 150k m3 in privately owned ones).

Montenegro’s wood industry is centered around the northern part of the country and counts 450 businesses that engage in wood processing, board, and veneer production.

Montenegro Energy Sector

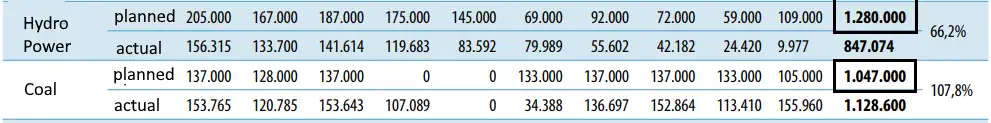

Montenegro’s energy needs are largely met by coal and hydropower which contribute roughly the same to total energy production.

source: EPCG

Hydropower capacity is dependent on rainfall: if the climate is drier than expected as was the case last fall, Montenegro needs to ramp up coal energy production or import energy. Montenegro exports more than it imports from January to April when the rainfalls are heavy and has a deficit in the remaining months.

However, Montenegro has committed itself to the ‘Green Transition’, wanting to take advantage of its natural predisposition that allows for wind and solar projects at a large scale.

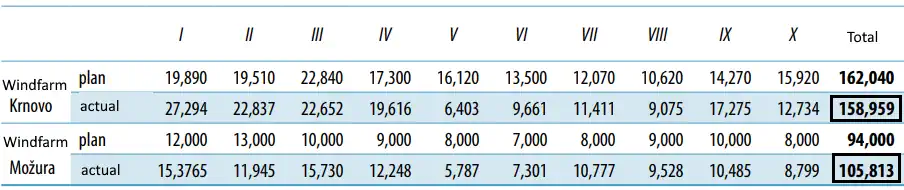

The two wind power stations ‘Krnovo’ and ‘Mozura’ combined produce about 250k MWh, one-quarter of the volume of the coal plant in Pljevlja.

But it seems that foreign investors are more interested in solar power. Just recently, four companies announced that they were going to move forward with their investment in solar power:

- Rozaje solar power plant valued at 200 million Euros

- Savnik photovoltaic plant with a 220 MW capacity

- Cetinje solar power plant with 225 MW capacity

- Briska Gora plant valued at 300 million

Taken together, these facilities will be able to produce almost one Gigawatt annually, which is the capacity that comes from Hydro and Coal power respectively.

Shortly, Montenegro will be a net exporter of mostly ‘green energy’ which it can feed onto the European Grid to which Montenegro is connected via an underwater cable.

Montenegro Exports and Imports

Montenegro’s current account balance amounts to 4,24 billion Euros, 44.1% higher than in the year 2021 with total imports of 3.5 billion Euros and exports worth 700 million.

The largest share of exports (almost 50% share in total export value) was made up of electrical energy (170,2 million Euros) and aluminum worth 171,3 million Euros. In 2021 both of these products constituted less than 145 million Euros combined.

At the same time, Imports increased from €2.5 billion to €3.5 billion.

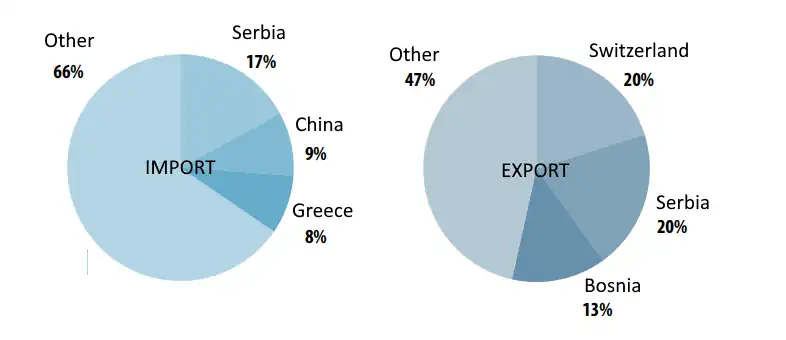

Its top three trading partners when it comes to imports, are Serbia followed by China, and Greece. Montenegro exports mostly to Serbia, Switzerland, and Bosnia and Hercegovina.

Top 3 Exported Goods (2021): Electrical energy, Aluminium, Oil & Mineral Fuels

Taken together, import and export volume figures indicate that Montenegro trades most of its products and services with countries that are either part of the European Union (EU) or the Central European Free Trade Agreement (CEFTA).

Montenegro Population

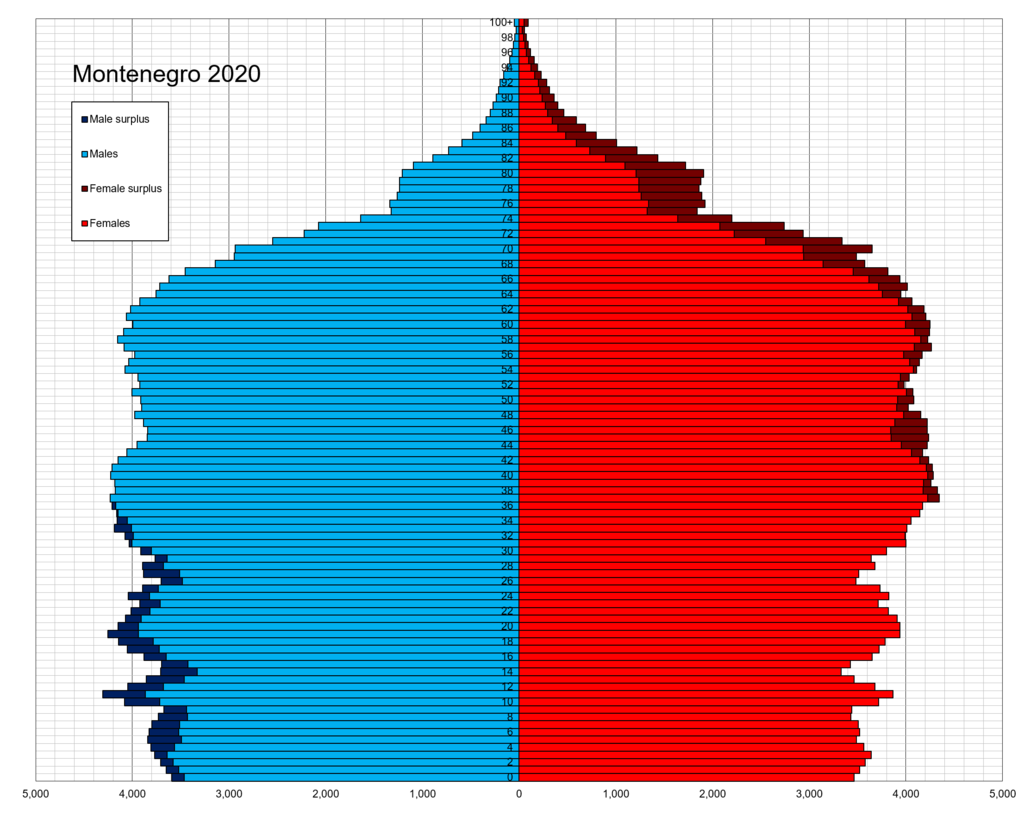

Montenegro currently has a population between 600,000 and 622,000 according to government estimates. The last time Montenegro’s population has been properly counted was in 2011 with 620,029 people. The next census is expected to take place during 2023 or 2024.

Most of the European Union and countries of the Western Balkans especially, face demographic problems on a major scale. There are not enough newborn children to sustain current population levels. In Montenegro, the situation is slightly better with a fertility rate of 1.81 children and a net migration surplus in some regions.

source: Wikipedia

When it comes to demographics, Montenegro is largely divided into the coastal region and capital city Podgorica which receives a net inflow of people, and other regions that slowly die out.

In 2022, Montenegro’s second-largest city Niksic lost 707 inhabitants. Niksic was known to be an industrial powerhouse during the Yugoslav years but the steel and metal sector has since been in a steady decline. The unemployment rate and the number of workers on minimum wage remain high, causing many young people to leave.

Since 2008, this city has lost more than 4.000 of its population (almost 10%) and the municipality is desperate to motivate its residents to stay: families now receive 900 Euros from the state for every newborn baby.

Is Montenegro a good country to invest in?

The European Commission has estimated that the EU’s foreign investment in Montenegro reached almost €200 million in 2022. The trade volume breached €1.5 billion in 2021. The EU will mobilize €30 billion in cooperation with the International Monetary Fund and the World Bank through an investment plan specifically for the Western Balkans.

Montenegro’s commitment to open markets, increasing private investment and strong property rights will likely boost economic development for years to come. Montenegro’s economy has some handicaps though: its financial sector is small (but liquid and stable) and domestic demand is small due to the country’s size.

Still, the investment opportunities in Montenegro are manifold.

Montenegro plans to become a regional center for congress and convention tourism. Companies specializing in resort and hotel management, theme park, and golf course developers among others have ample time and space to grow. Montenegro is far from being a mature market.

Fast food franchises, casinos, and leisure facilities all have excellent chances to position themselves in this still-emerging marketplace.

Challenges

In particular, the public administration and infrastructure facilities lack behind. Decades of socialist rule and ensuing years of dysfunctional institutions present a challenge for ambitious projects of scale. It is not always easy to obtain permits and licenses.

Further, the workforce is small and in parts not well-equipped with the skills required in the modern work environment. Local companies operating in Montenegro can only depend on a small pool of labor. This represents an obstacle to fast growth and competitiveness.